Take advantage of the Section 179 Deduction early in the year, buy the equipment you need to optimize your work for next year, and save big. Looking for work trucks in addition to industrial equipment for your fleet? As a division of All Roads, we have access to new Ford, Kenworth, and Isuzu trucks so you can experience a one-stop-shop!

What is Section 179?

Section 179 is a tax incentive that allows businesses to deduct the full purchase price of qualifying equipment purchased or financed during the tax year. It’s an incentive created by the U.S. government to encourage businesses to buy capital equipment, invest in themselves, improve operations, and increase revenue.

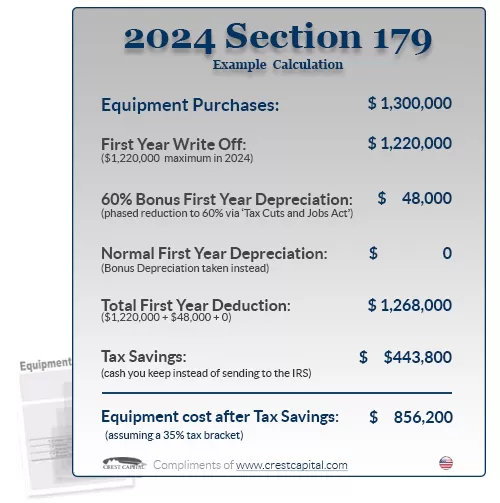

At a Glance – 2024

$1,220,000

2024 Deduction Limit

New and used equipment purchases qualify for the deduction. Qualified financing is available for Section 179 as well.

$3,050,000

2024 Spending Cap on Equipment Purchases

Once this amount of spend is reached, the deduction available is reduced. Bonus Depreciation is an option for companies who spend more than this limit.

60%

2024 Bonus Depreciation

Bonus Depreciation is offered to companies who have spent over the cap. It is available for both new and used equipment.

Example Calculation

*The Section 179 deduction has exceptions. Not all equipment purchases qualify. To take the deduction for current tax year, the equipment must be paid for in full, physically delivered, and put into service between January 1 and the end of the day on December 31 of this year to meet federal guidelines.